Sustainability

Sustainability is in our DNA

Since our founding, SK Capital’s mission has been to sustainably create and capture value for our stakeholders in all economic environments.

Sustainability is an important feature of our firm’s purpose and integrated into our investment strategy:

- We make investments and manage assets to achieve superior returns that are durable and lasting.

- Improving the sustainability performance and profile of each portfolio company increases its overall value and generates more favorable returns.

- By their very nature, our sectors of focus are uniquely positioned to enable enhanced living standards and a more sustainable future.

We seek investments where SK’s vision, partnership, and unsurpassed industry experience can make sustainability an important part of a company’s transformation.

objectives

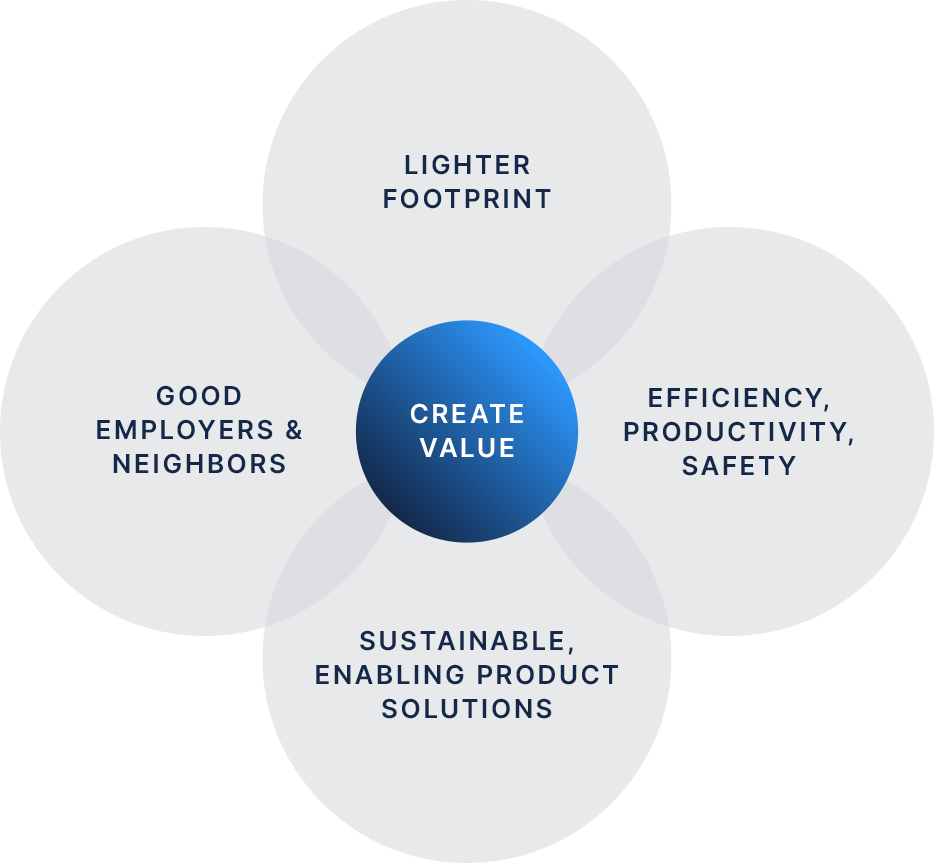

SK’s commitment to sustainability means working with each portfolio company to continuously pursue SK’s portfolio-wide sustainability objectives and enhance the value of each portfolio company by:

- Reducing environmental impacts

- Acting as good employers and neighbors

- Improving efficiency, productivity, and safety

- Adopting and creating sustainable, enabling solutions

Air purification textile technology

Archroma

Principles

We acknowledge that as leaders in our sectors of focus, there are unique opportunities for SK and our portfolio companies to seize and imperatives we all must tackle:

Specialty materials, ingredients, and life sciences are essential to a healthy, more sustainable future. SK portfolio companies are uniquely positioned to meet demand for products that help enable a low-carbon, renewable and circular future.

To fully capitalize on the projected growth of our targeted sectors, transforming both processes and products to be safer and more sustainable are critical.

Our Sustainability strategy is Built on the Following Principles

We assess each company, starting with common priorities, to determine which opportunities and risks are most relevant.

By collaborating with company leaders, stakeholders, service providers and experts, like the UN’s Principles for Responsible Investing (UNPRI) organization, we bring ideas, capabilities, and credibility to our work.

We build strategies and track progress so each company in our portfolio can improve.

Systematic Approach

SK will strive to integrate the consideration and thoughtful management of sustainability and ESG matters throughout the investment cycle. This approach allows for consistency and predictability, while also remaining agile to adapt to unique company circumstances.

Sustainability for value creation

Sustainability is innately valuable because it is good for our environment and the people who live in it.

As a firm that transforms companies to create value for stakeholders and investors, we start by pursuing opportunities that will produce sustainability and operational, financial and/or productivity gains.

SK has instituted initiatives to identify opportunities to lower energy bills, increase efficiency, and reduce greenhouse gas emissions at portfolio company facilities.

An important way we evaluate our strengths is by looking to certified ESG and Sustainability systems like EcoVadis. We are proud of our portfolio companies that have achieved strong EcoVadis assessments.